Melbourne rental affordability plummets

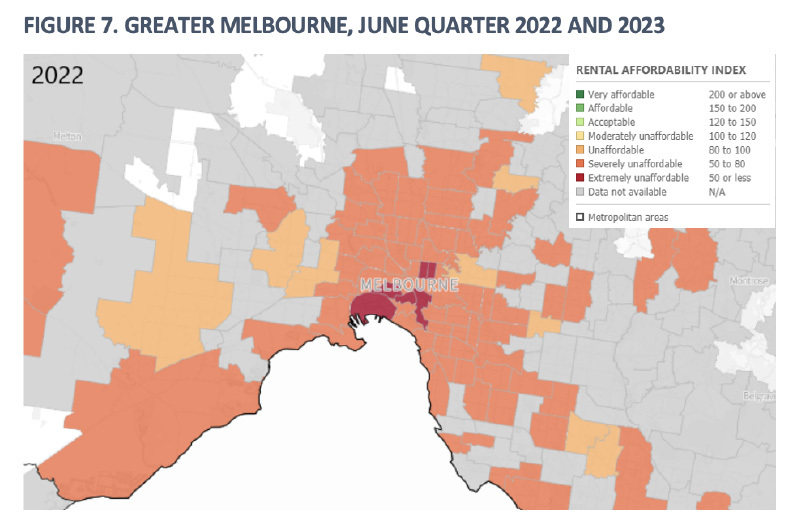

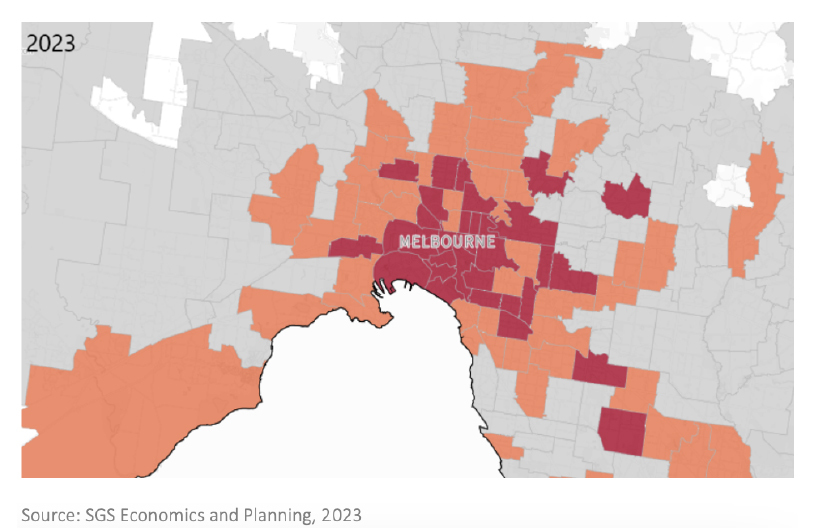

A landmark analysis by National Shelter and SGS Economics and Planning shows rental affordability across greater Melbourne plummeting 10 per cent in just 12 months, with previously affordable rents across an entire swathe of the city all but vanishing and particularly impacting people on low incomes.

The latest National Shelter-SGS Economics and Planning Rental Affordability Index for greater Melbourne shows an average rental property costs 24 per cent of the average household’s income of $108,955.

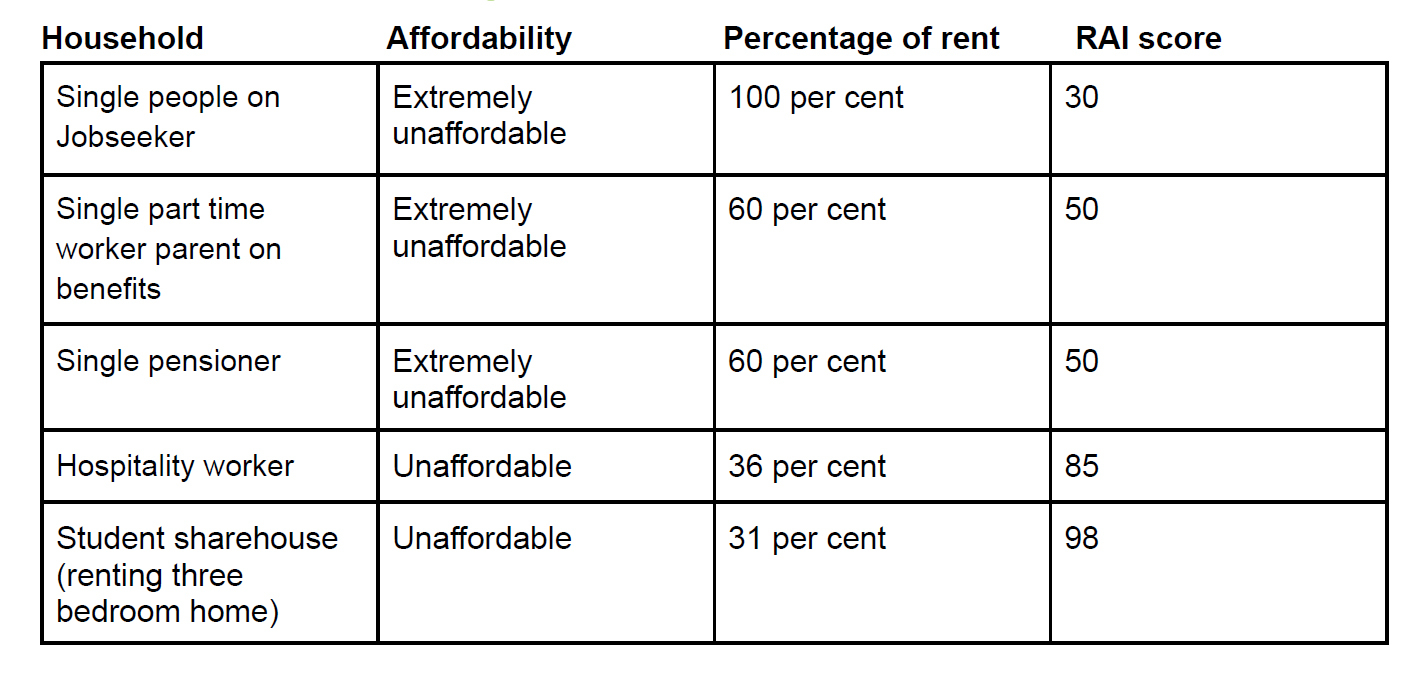

For people on low incomes such as single people on Jobseeker, single or coupled pensioners, and single part time worker parents on benefits, rents were classed as either extremely unaffordable or severely unaffordable.

“In Melbourne, students and people on lower incomes are priced out of entire swathes of the city. The rental market is fundamentally broken,” Emma Greenhalgh, CEO National Shelter, said.

“Melbourne’s rental market is in a crisis and it’s only getting worse. This disproportionatelypunishes people with the least while also pricing full-time and essential workers out of their owncity.

Chief of Services at Brotherhood of St Laurence, Julie Ware, said: “The private rental market is failing people on low incomes and we cannot afford to simply tinker around the edges of reform.

“A major overhaul of how we treat housing is crucial to ensuring people can afford to live in communities with adequate infrastructure and essential services such as healthcare, schools and transport.”

Principal at SGS Economics & Planning, Ellen Witte, said: “An entire corridor, stretching from Footscray in the inner west north to Meadow Heights, was considered ‘affordable’ to the average rental household just last year. As of the June 2023 quarter, those options that cost less than 15 per cent of a household’s gross income had all but vanished.”

The rental index gives Australia’s second-largest city an overall affordability rating of 126, which is rapidly approaching what the analysis considers moderately unaffordable. While Melbourne remains the country’s most affordable capital for renters, rental affordability has continued to decline from its pandemic downturn-induced high of mid-2021 (when the RAI was 151).

Rental affordability has dropped 10 per cent since the June quarter of 2022 and returned to 2018 levels offsetting all gains made during the pandemic. Rents have risen 16 per cent over the past year, driven mainly by rapid price rebounds in one and two-bedroom apartments that now exceed pre-pandemic levels.

Acceptable rents (requiring less than 25 per cent of gross income) in areas like Docklands and Southbank have also disappeared. Now, the average rental household needs to look as far out as Sunshine (15km from the CBD) to find affordable rentals at the median rate.

“Unaffordability has spread from the cities to well into the regions. Households will have to live further away from where the jobs are to access affordable rents, and businesses are struggling to find workers.", Ms Witte said.

She also said strong reform was needed.

“This downward spiral has now reached the point where very few affordable long-term rentals are on offer. We need to attack this problem from multiple angles. This means expanding social and affordable housing, rethinking how we use tax subsidies and strengthening renters’ rights.”

EDITOR’S NOTE:The rental affordability index scores areas based on median rental prices and average income of rental households within the capital city or rest of state area’. A score of 100 indicates households spend 30 per cent of income on rent, the critical threshold level for housing stress. A lower score is worse.

A score of 50 or less indicates extremely unaffordable rents, 51-80 indicates severely unaffordable rents, 81-100 indicates unaffordable rents, 101-120 indicates moderately unaffordable rents, 121-150 indicates acceptable rents, 150 or more indicates affordable rents.

Media contact:

Georgie Moore: 0477 779 928